FEATURES

The MomentumDetector is an intraday market scanning application that continiously scans the U.S. stock market during trading hours. It identifies stocks reaching new intraday highs and lows based on customizable or fine tuned pre-configured screening criteria. The software also generates curated lists of top gapping stocks and leading percentage gainers.

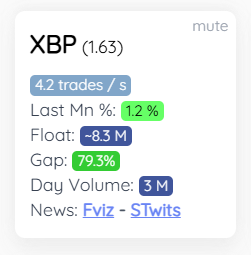

Stock card

Stock candidates matching scanning settings are represented with a card containing all the information to judge if the stock warrants your precious attention and time:

- Mute: to prevent that stock from showing up in scanning results for the next 30 minutes.

- Ticker and last price

- Last minute price movement and average trades per second

- Current daily volume and float

- Gap % (changes to % since open during regular trading hours)

- Easy access to news

- Each data has a colored background. The darker, the higher the intensity.

“Trades per second is an exclusive criteria we use to make sure that the stocks showing up in your scanners are supported with intense traders activity.”

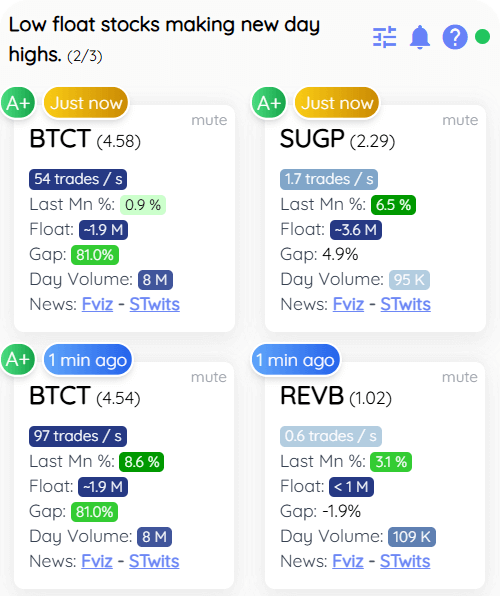

Stocks making Day High / lows

The MomentumDetector scanners will scan the entire stock market and look for potential immediately tradable candidates making new day highs or lows.

Candidates responding to the scanners criterias will apear in a chronological list. It is possible to enable an audio notification.

On the image, you can see that in the last minute (identified by the “Just now” bage) two candidates responded to the scanner “Low float stocks making new day highs”. You can see that BTCT traded 54 trades per second on average on the latest minute, which is less than a minute ago (97 trades /s) but still an indication of an intense activity.

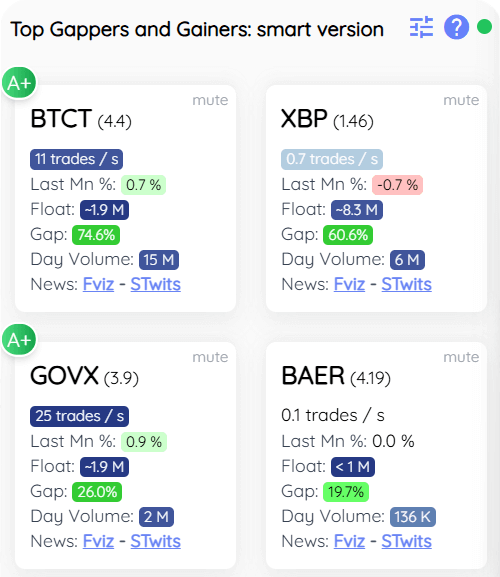

lists

Smart stock scanner that lists and displays high-potential gappers and gainers throughout the trading day.

Unlike traditional top gainers lists, this smart scanner implements filtering to surface higher quality trading candidates:

- Pre-Market: Displays top percentage movers relative to previous day’s CLOSE.

- Regular Market Hours: Automatically switches to show top gainers from market OPEN.

- Momentum: Excludes low-activity stocks with no trades in the last minute.

- Volume: Requires minimum daily trading volume thresholds.

- Performance: Must show minimum 5% move from previous close.

This combination helps identify the most promising gainers for the day. Traditional lists also available.

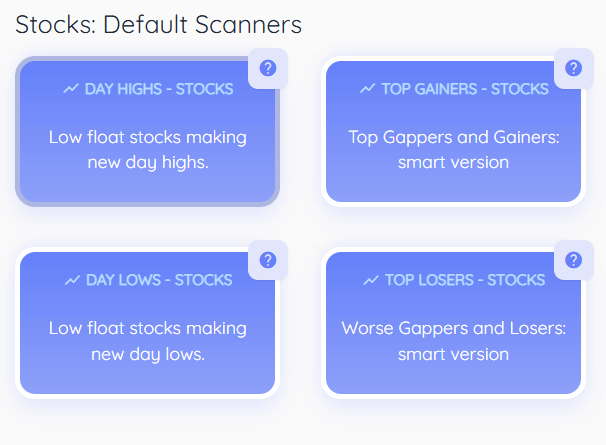

out of the box scanners

It takes less than 2 minutes to subscribe to the MomentumDetector and launch a built in Scanner.

Built in scanners are fin tuned to find high potential stocks.

Included fine tuned scanners:

- High potential low float stocks making new day high / low

- List: Improved top gainers

- List: Standard top gainers, losers

For both listed on OTC stocks.

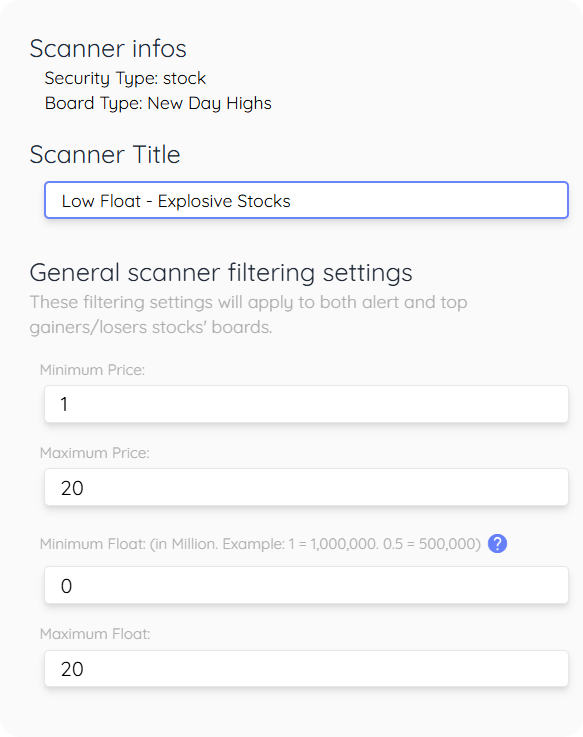

Custom Scanner general settings

The MomentumDetector comes out of the box with fine tuned scanners to detect the most explosive stocks.

But it also allows you to define your own scanners with your own filtration criterias, for both day High/lows and top gainers / losers lists.

General settings options:

- Minimum price

- Maximum Price

- Float minimum

- Float maximum

A stock float is the total number of shares that are available for public investors to buy and sell.

The less float available, the easier it is for the stock to move up or down.

A low float stock is a key characteristics of those stocks that make huge intraday moves.

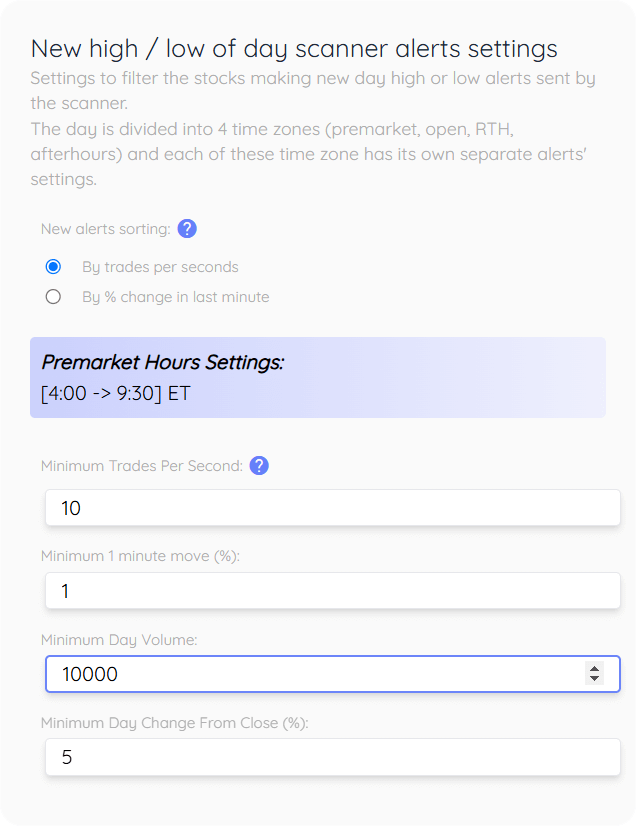

Custom Scanner to detect day highs and lows

Custom day high / low settings will filter stocks making new day high or low according to the settings defined in your custom scanner.

Custom day high / low settings options:

- Minimum Trades per seconds (average over the last minute).

- Minimum last minute % move

- Minimum day volume

- Monimum Day % change from previous day close.

The MometumDetector gives you all the tools to find truly active stocks moving, and ready for more.

PRO TIP:

Trades per second is particularly effective to use on low float stocks, which can be dormant for days, then explode in activity on a news catalyst.

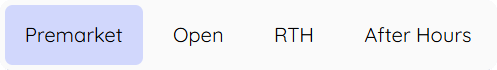

per session settings

Another exclusive feature: The MomentumDetector adapts to the unique rhythm of each trading period, allowing you to customize distinct day high / low scanner settings for four distinct market phases:

- Premarket: 4:00 AM – 9:30 AM ET

- Market Open: 9:30 AM – 9:38 AM ET

- Regular Trading Hours (RTH): 9:38 AM – 4:00 PM ET

- After Hours: 4:00 PM – 8:00 PM ET

Trading activity vary significantly throughout the day. The intense activity of market open differs dramatically from pre-market conditions, while pre-market trading intensity differs from regular trading hours.

Why settle for one-size-fits-all settings when market dynamics change by the hour? With the Momentum Detector, you can fine-tune your filters for each major trading period, ensuring you receive high quality candidates throughout the day.

other features

Works in any web browser.

No installation required. The MomentumDetector works on any windows, apple, android or linux device with a web browser.

All major US stock exchanges covered

We scan for day High/Lows and top lists from US listed echanges: Nasdaq, Nyse, an Nyse Americain, as well as OTC stocks in a separate subscription packages.

Pre Market, After Hours included

Our scanner start scanning from the first minute of the Pre-Market at 4AM ET, until the last minute of the After-Hours period at 8PM ET.

Backup your custom scanners

Custom scanners can be backed up in the cloud, and restored on another device.

Mute a stock

A muted stock will not show up in your day High/Low scanners for the next 30 minutes.

MOMENTUM

DETECTOR

© MomentumDetector

By accessing, browsing, or using this website and any of its services, tools, content, or features, you explicitly acknowledge that you have read, understood, and unconditionally agree to all the terms, warnings, and risk disclosures contained in this disclaimer. You accept that your use of this site and its services constitutes your implicit consent to these terms and your recognition of all associated risks. If you do not agree with or accept any part of these risk disclosures and disclaimers, you should immediately discontinue use of this website and its services.f